E-Commerce Survival Guide for Black Friday and Cyber Monday

Have you started prepping for Black Friday and Cyber Monday?

If you’re not getting ready, you should be. It’s (almost) the most wonderful time of the year for e-commerce retailers, and making the most of the madness requires proper planning.

Of course, deciding what to focus on can be a challenge in itself. Which platforms should you be thinking about? How much volume should you expect? Where should you be targeting your marketing spend?

To help you successfully strategize, we’ve sorted through data from last holiday season and highlighted five key trends every e-commerce retailer should be thinking about this Black Friday and Cyber Monday.

Here they are, in no particular order:

1. Be Prepared for a Lot of Volume

According, to 2013 data, Black Friday online sales were up 19% last year compared with 2012, and Cyber Monday online sales grew by 20.6 %.

This huge jump came off an already sizeable amount of spend, meaning that the e-commerce volume was mind-boggling in 2013. On Black Friday alone last year, comScore estimates consumers spent nearly $1.2 billion online.

What should you expect this year? Deloitte is forecasting a 4% to 4.5% increase in holiday spending compared with 2013. That number is for both offline and online, and it’s very likely that e-commerce could account for the lion’s share of growth.

So, what does that mean? Be prepared for the possibility of another very big jump in e-commerce volume (perhaps even double digits) this year.

2. Mobile is Huge (and Nuanced)

You’ve probably heard this over and over (and over) recently, but it bears repeating: mobile has transformed e-commerce. This is true across all types of online shopping, and holiday spend is no different.

On Black Friday last year, mobile accounted for 39.7% of all online traffic to e-commerce retailers, increasing by 34% over Black Friday 2012. That share is expected to be even larger this season, and should cross the 50% threshold soon.

When thinking about targeting this ever-growing group of mobile shoppers, make sure to keep in mind that consumers on various platforms and devices behave in very different ways.

For example, while Android has a significant mobile OS market share, Custora estimates that 83% of mobile orders during last year’s holiday season were made on Apple iPhones or iPads.

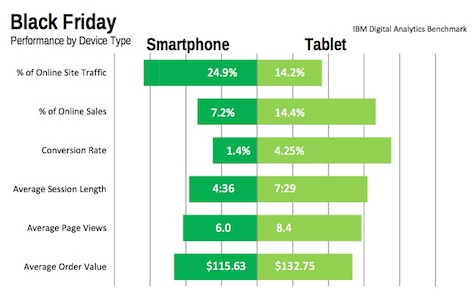

Another example of nuanced mobile behavior is the difference between how smartphone and tablet shoppers use their devices. As IBM put it in a round up of 2013 holiday data: “Smartphones browse, tablets buy.”

This trend can be seen in the numbers—smartphones accounted for a larger share of holiday traffic to e-commerce sites last year but tablets accounted for more sales.

3. Black Friday and Cyber Monday Behavior Differs

For many Americans, Black Friday is a day off, whereas Cyber Monday is a workday. That simple fact has a big impact on e-commerce shopping behavior.

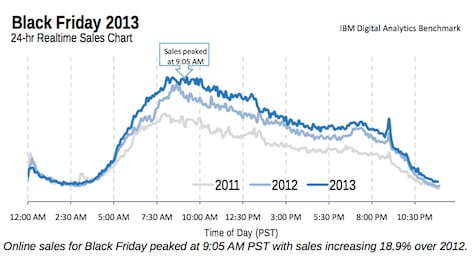

This can be seen most clearly when looking at volume on each day. IBM’s benchmarking data for 2013 shows that Black Friday sales on e-commerce sites peaked at 9:05 AM PST and then steadily declined throughout the day.

Conversely, on Cyber Monday, volume ramped up around 8:00 AM PST, stayed steady during daytime hours, and then jumped even higher in the evening.

Why is this important? Because it means tactics need to be tweaked on each day to account for different engagement patterns.

4. Don’t Neglect Established Digital Channels

Each year it seems like there is a fresh crop of social media networks and digital platforms to worry about.

These newbies are important—and should absolutely be experimented with—but when it comes to Black Friday and Cyber Monday, make sure to pay plenty of attention to the established digital channels. They may not be as sexy, but they’ve been proven to drive sales.

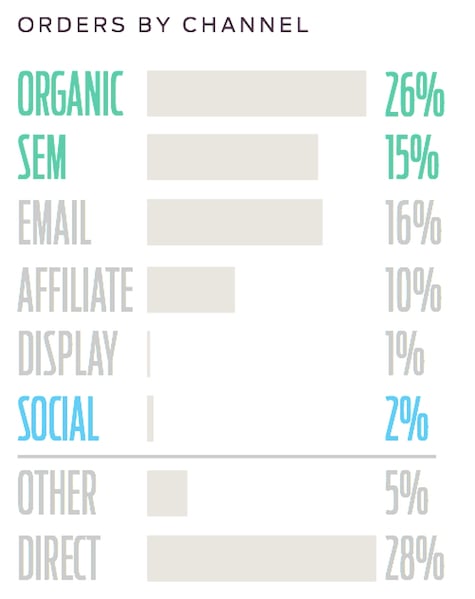

In particular, email and search remain essential to e-commerce engagement. Custora estimates that 26% of online orders during the 2013 holiday season originated from organic search, 15% from paid search, and 16% from email. Put another way: more than 50% of all e-commerce volume came from these two digital workhorses alone.

5. You’ve Got Competition

Finally, as you start craft your Black Friday and Cyber Monday plan, keep this mind: consumers are being bombarded with e-commerce messages during this time.

As an example, IBM found that retailers sent 37% more mobile push notifications during the two-day period of Thanksgiving Day and Black Friday. Similar increases in volume apply across all other channels, including email and social media.

That doesn’t mean you shouldn’t compete, but it does highlight the fact that your messaging must be both engaging and well timed to break through the noise.

Of course, if you do succeed in standing out, the payoff can be huge: this Black Friday and Cyber Monday are very likely to break last year’s e-commerce traffic and sales records. That’s some holiday cheer, indeed.

Leverage powerful new e-commerce strategies this holiday season. Contact MDG today at 561-338-7797 or visit www.mdgsolutions.com.

MDG is a full-service advertising agency and one of Florida’s top branding firms. With offices in Boca Raton and New York City, MDG’s core capabilities include branding, logo design, print advertising, digital marketing, mobile advertising, email marketing, media planning and buying, TV and radio, outdoor advertising, newspaper advertising, video marketing, retail marketing, Web design and development, content marketing, social media marketing, and SEO. To discover the latest trends in advertising and branding, contact MDG today at 561-338-7797.